Buying property particularly a house will be for most New Zealanders the largest financial investment of their lives. The last thing you want is to purchase a property that you later discover with long term maintenance required or remediation costing you potentially tens of thousands of dollars. A one-off expense of an inspection makes you fully aware of any major issues and leaves nothing to chance.

Just as a LIM costs money from your local council to detail council consents for work done on the property and geographic hazards, it is well worth the cost of talking to a building inspector as you really do not want to sign a sale and purchase agreement and make an unconditional offer for a leaky home!

What is a property inspection report?

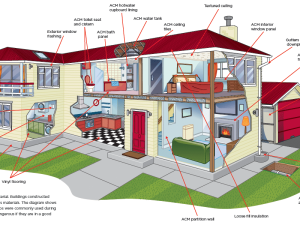

Pre-Purchase house inspections are non-destructive, visual inspections of the property, specifically targeting these five areas:

- Exterior and interior roof space areas and materials

- Evaluation of under the floor area including the foundation, framing, insulation, leaks and ground moisture

- Interior/exterior of the property including windows, floors, ceilings, exterior walls and any specific services systems

- Other structures on the site such as sheds and garages

- The site location itself, including factors like drainage, retaining walls, driveways and fencing.

Building inspectors supply a comprehensive written report outlining any current defects or potential issues, suggest remedial actions and can also recommend qualified professionals you can approach for assistance.

Gain peace of mind with a pre purchase property inspection

A Jim’s building inspector takes the place of your builder mate from the past who ran his tradies eye over your potential purchase for you, however, Jim’s eye is far more critical and trained to spot potential as well as actual problems.

The key indicators the inspector is looking out for alert him to issues that may require further investigation. He is also skilled in discriminating between normal gradual deterioration that may not be major problems relating to normal age-related matters, compared to issues with significant repairs needed.

How to turn a pre purchase inspection report into a valuable negotiating tool

Once the building inspectors work is done the building inspection report not only outlines the state of the property it also, if there are issues that could cost a significant amount of money, provides you with a powerful negotiating tool to discuss with the real estate agent.

What at first was perceived as a negative setback, say the future cost of a new roof which nearly made you walk away from the house can now be used to negotiate a substantially reduced price.

Important things to look out for in building reports.

Major red flags particularly in older homes and many wooden houses in New Zealand include issues with wood borer, asbestos, dux piping, aluminium foil and leaky homes. All of these can be very expensive to remedy and potential buyers need to be aware of them.

Using a building report provided by the vendor’s real estate agent may seem like a cheap option however, if you buy the property and then find problems with it that are expensive to fix, you are not protected by the building report because the inspector’s contract is with the seller rather than you.

How long does a property inspection report take?

An average house inspection will take between one to two hours depending on the property size and the number of defects found. A Jim’s report will be prepared and available for most houses within 24 hours.

You are welcome to accompany the building inspector however the inspection will inevitably take longer.

So, Is it worth getting a building report?

Yes. As you can see from the above, the question is: is it worth the risk of not getting a building report?

Remember, if finances are tight and you do not feel comfortable paying for a building inspector you can discuss with the real estate agent working with you about making an inspection a condition of your offer.

The Real Estate Authority (REA) recommends using an accredited property inspector who complies with the New Zealand building inspection standard 4306:2005 like Jim’s Building Inspections. This standard requires a visual inspection according to an extensive checklist, and the inspector is required to have professional indemnity insurance.

Contact Jim’s for your pre purchase report requirements, it will be well worth it.